Best SBI SIP Plan 2025 :SBI mutual fund offers various types of mutual funds to invest as SIP or Lumpsums. There are plenty of SBI mutual fund schemes where investors can choose the MF to invest according to their risk tolerance.

SBI mutual fund is the largest AMC in the country and as of August 2025, SBI MF’s AUM was around ₹11.92 lakh crore. SBI mutual fund is trustable mutual fund house and it has an easy process to start a sip or mutual fund with minimum documents.

In this article we will know how ₹1,000 Per Month SIP Became ₹55 Lakh and which mutual fund scheme was it.

Table of Contents

Best SBI SIP Plan 2025 – SBI Contra Fund

SBI Contra Fund is one of the most performing mutual fund schemes that has given decent returns over the time. SBI Contra Fund was started on 14-Jul-1999 and till date it has given 19% return since inception.

Lets know how this SBI Contra Fund has made wealth for investors in the long term.

Lets suppose Mr Ram invested in this fund and started SIP of just ₹1,000 Per Month and invested till 25 years. As this fund has given 19% return per year. According to this data the Fund has become aprox 70 lakh now.

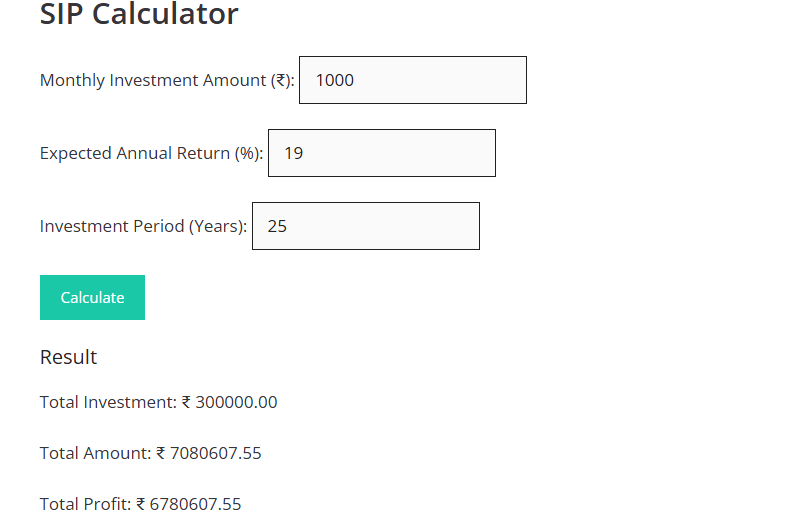

Let’s do calculation using SIP Calculator

- SIP Amount = ₹1,000

- Rate of Return = 19% PA

- Tanure = 25 Years

- Total Investment: ₹ 300000.00

Total Amount: ₹ 7080607.55

Total Profit: ₹ 6780607.55

Also Read:- SBI Special FD Scheme For 400, 444 & 555 Days

Best SBI SIP Plan 2025 : Overview of SBI Contra Fund

About SBI Contra Fund

SBI Contra Fund is one of the most popular equity mutual funds in India, managed by SBI Mutual Fund. Launched over 26 years ago, it follows a contra investment strategy, which focuses on identifying undervalued opportunities that are often overlooked by the market.

With a strong track record, the SBI Contra fund has delivered 18.97% returns since inception, making it attractive for long-term investors and making it Best SBI SIP Plan 2025.

The scheme carries a very high risk rating, so it is more suitable for investors with a 3+ year investment horizon who are comfortable with equity market volatility.

As of September 15, 2025, the fund’s AUM stands at ₹46,655.07 crore, and the NAV is ₹382.1230.

Investors can start with a minimum lump sum of ₹5,000 or a SIP of ₹500, making it accessible to both first-time and seasoned investors.

SBI Contra Fund – Key Details

| Attribute | Details |

|---|---|

| Fund Type | Equity – Contra |

| Returns Since Inception | 18.97% |

| Risk Rating | Very High |

| AUM | ₹46,655.07 Cr |

| NAV (Sep 15, 2025) | ₹382.1230 (0% One-day change) |

| Suitable For | Long Term (3 years +) |

| Minimum Initial Investment | ₹5,000 |

| Minimum SIP Investment | ₹500 |

| Fund Age | 26 Years |

For more Info visit SBI MF official website

Final Thought

SBI Contra Fund has consistently rewarded patient investors with strong long-term returns, backed by its contrarian investment approach. With an impressive 18.97% returns since inception, robust AUM of over ₹46,000 crore, and the credibility of SBI Mutual Fund, it stands out as a reliable option for wealth creation.

However, given its very high risk rating, this fund is best suited for investors with a long-term horizon (3 years or more) who can withstand market volatility. If you are looking to diversify your portfolio with a high-growth equity scheme, SBI Contra Fund can be a smart choice.

Disclaimer: The information provided in this article is for educational and informational purposes only. It should not be considered as investment advice. Please consult your financial advisor before making any investment decisions.